Private school choice 101

Private school choice has gotten a lot of attention in Jefferson City during the opening weeks of the 2021 legislative session, with parents from across the state coming to the capitol to share their stories and ask for more educational options.

While these parents would be happy with any help the state legislature can provide, there are some differences in the various bills that have been filed to create Missouri’s first private school choice program.

Here is a breakdown of the differences between the bills and some myth-busting of common misperceptions about private schools and school choice.

ESA’s versus 529 plans

While several bills that have been filed would use the MOST 529 educational savings program as a vehicle to offer scholarships to students it is important to not confuse 529s with the Empowerment Scholarship Account, or ESA’s, being proposed this year.

The Empowerment Scholarship Account legislation that is being considered this year are designed to help families access a wide variety of educational options by helping them afford to attend a private school, pay for homeschooling expenses or pay for tuition at public school outside of the district they live in.

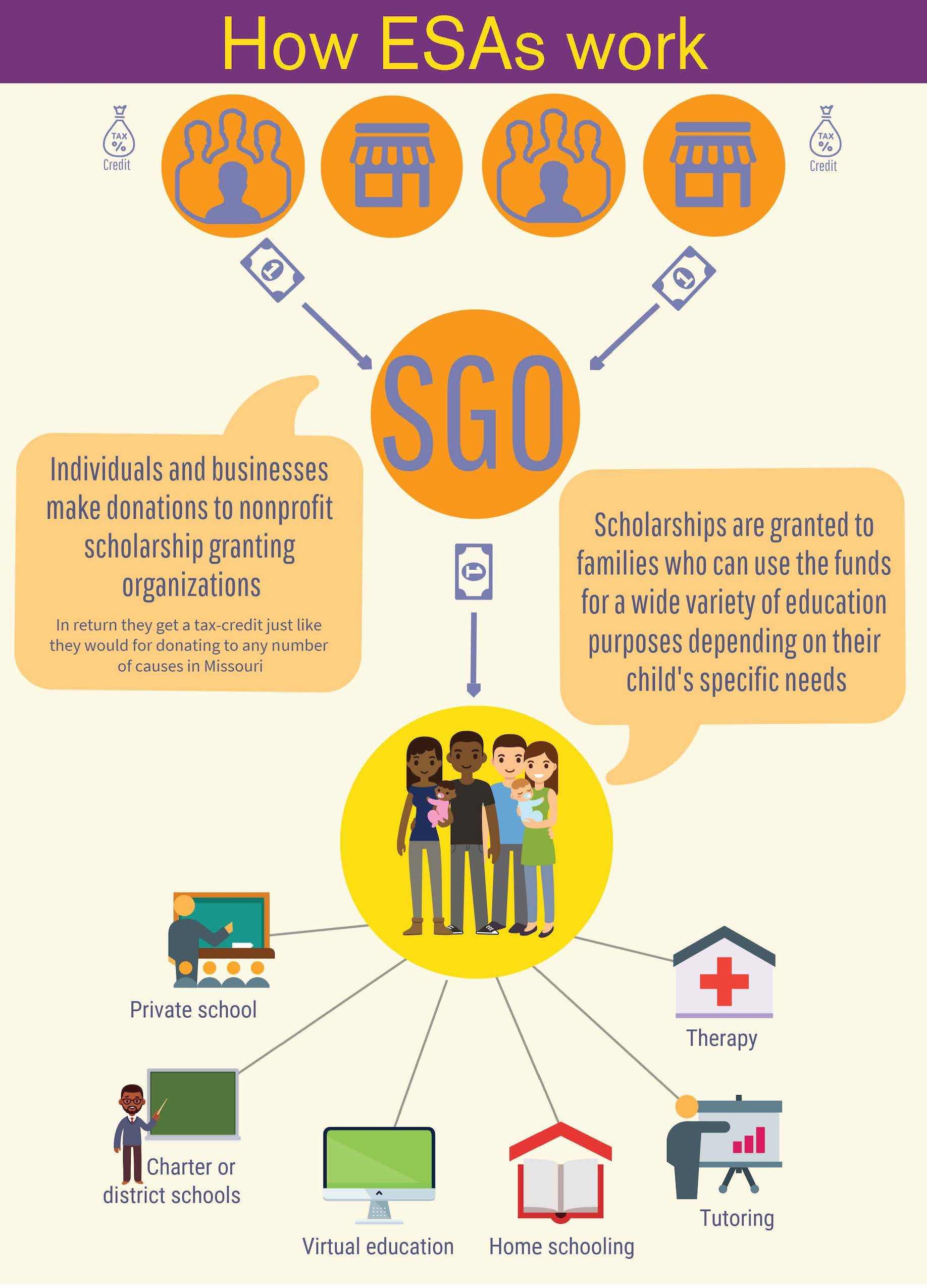

Under the Empowerment Scholarship Account plan, individuals or companies (not the family benefiting from the ESA) would make a donation to a scholarship granting organization and, in return, the donor would receive a tax credit close to the value of their donation.

The scholarship granting organization would then use the donations to offer scholarships for families that qualified for an ESA and those families could use the funds to pay for public or private school tuition, homeschooling costs, tutoring, therapy, or virtual education expenses.

A second private school choice plan that has been proposed, called the Show Me a Brighter Future Scholarship, would be administered by the state Treasurer’s Office instead of a scholarship granting organization.

Under this proposal, donors (not receiving families) would contribute to a fund managed by the state Treasurer and would still receive a tax credit for their donation. The treasurer’s office would then create a MOST 529 account for students qualifying for a scholarship based on their family income and the receiving family could use the funds in that account to pay for private school tuition.

This proposal is different than the way the MOST 529 program currently works in Missouri.

The MOST 529 program was originally designed to help families save for college tuition by offering a variety of tax incentives. As part of the federal tax overhaul in 2018 these benefits were extended, and the program now allows families to receive the same tax benefits if they use 529 funds to pay for K-12 tuition.

Under the existing 529 program, families deposit their own money into a 529 account and then use the 529 accounts to pay for qualified expenses to receive the tax benefits.

While this is certainly a benefit for those who can afford to contribute to a 529 account, the proposed Empowerment Scholarship Accounts and Show Me a Brighter Future Scholarship programs would provide funding for educational options to families who could not afford those options otherwise.

ESA’s are not vouchers

Opponents of expanding educational options in Missouri love to use negatively charged words like vouchers to describe private school choice proposals, but the reality is that what is being proposed in Missouri is very different than voucher programs in other states.

While both types of programs give parents access to more school choices, there are some very key differences that make ESAs a much better option for the state and for families.

Vouchers provide direct public funding for private school education in the form of a voucher that parents can use to cover some or all of tuition at a private school. In a voucher program, the funding goes directly to the school which may conflict with Missouri’s Blaine Amendment.

Empowerment Scholarships Accounts would provide funding directly to the family and allow them to choose what is best for their children. Families would be able to use Empowerment Scholarships to pay for tuition at another district or charter public school, pay for tuition at a private school, or use the funds to help homeschool or supplement other education options by employing a private tutor, purchasing textbooks, paying fees for Advanced Placement exams, or contracting for specialized therapies.

ESAs are NOT funded through state funds

In some states, school choice initiatives are directly funded through the state budget.

The Empowerment Scholarship Accounts proposed in Missouri would NOT be funded through general state revenue.

The proposed ESA plan would be funded by private donations from individuals and businesses given to nonprofit scholarship granting organizations. In return, the donors would receive a tax credit.

This means that no funding for ESAs would ever move through the state budget.

Common myths about private schools

Myth #1: Private schools are only for rich kids

This is probably the most prevalent myth about private schools and could not be further from the truth in Missouri.

The reality is that private schools serve a wide range of students, both urban and rural and rich and poor. There are some private schools that charge very high tuition and serve more affluent families.

But there are also many private schools that serve children in poverty and many that serve middle-class families.

While base private school tuitions in Missouri can range from $1,750 to $41,000 per year many students do not pay any tuition at all, instead of attending private schools on scholarships or as part of a tithe based tuition plan.

Myth #2: Private schools are all religious

While many private schools are religious, there are also many independent private schools in Missouri that are not affiliated with any religious institution.

There is also a lot of variety in the faiths that religious private schools are associated with. In Missouri, we have Catholic schools (some of which are part of a larger school system and some that operate independently), Lutheran schools, Jewish schools, and Independent Christian schools just to name a few of the options open to families.

Myth #3: Private school teachers get paid a lot

Just as many people make the false assumption that you have to be rich to attend a private school, many people think that private school teachers and administrators are paid more than their public school counterparts.

“That is not the truth at all,” said Dr. James Shuls, Assistant Professor at the College of Education at the University of Missouri at St. Louis and program director for UMSL’s Educational Leadership and Policy Studies programs. “On average private school teachers make less than traditional public school teachers.”

« Previous Post: School choice opponents fact-checked by Missouri senator

» Next Post: House committee hears about the need for more education options