JUST THE FACTS: ESAs save the state and school districts money

(This is the first in a series of posts clearing up misconceptions that opponents of school choice are spreading in the capitol and across the state.)

Empowerment Scholarship Accounts (ESA) have a proven record of opening the doors to more educational options in states across the country, giving families the freedom to choose the education that best fits their child.

There is a widespread misconception that these programs may “siphon funds” from traditional public schools and hurt public education funding.

This is simply not true.

In fact, these programs have helped other states save money, funding that can then be reinvested in the public school system.

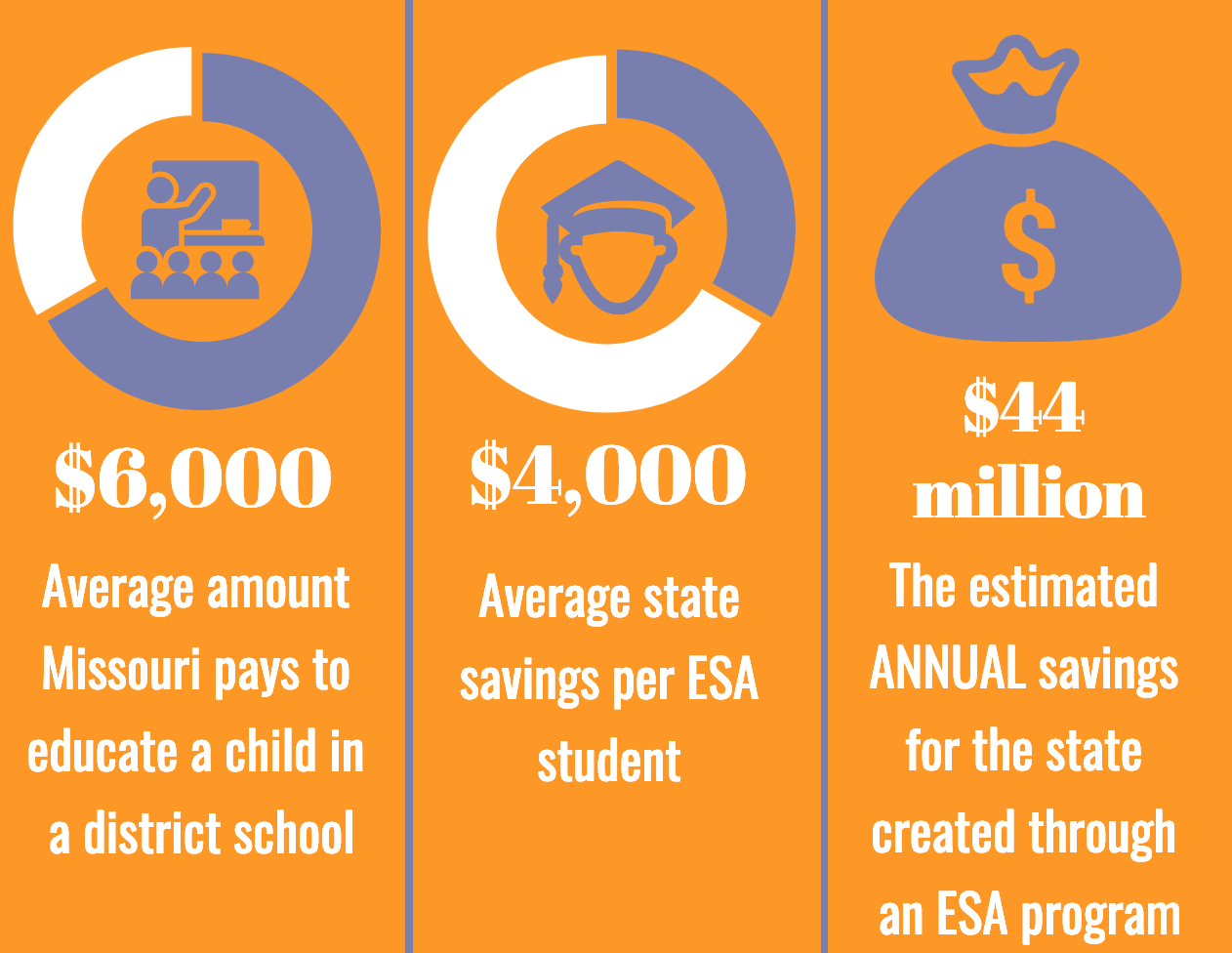

In Missouri, the Committee on Legislative Research Oversight Division (which analyses the fiscal impact of legislation in Missouri) predicts that Empowerment Scholarship Accounts would save the state about $44 million per year when fully implemented and save school districts statewide over $97 million collectively.

How is that possible? It really comes down to simple math, so let’s do that math.

How the state saves money

Under the proposed ESA legislation, students participating in the program would receive a scholarship that they could use to leave their assigned school to attend another public school, a private school or be homeschooled.

Currently, the state pays district schools about $6,000 per year, per student. If a student receives an ESA, then the state would not spend those funds on the student.

Instead, under an ESA program, a student’s family would receive a scholarship that would be funded through a tax credit supported donation system.

The scholarship

Many private schools charge as little as $3,000 for tuition, and homeschooling can be even less expensive.

Additionally, scholarship granting organizations may limit the amount of a scholarship based on financial need in order to ensure as many students as possible can benefit from the program.

Given those reduced costs, the Committee on Legislative Research Oversight Division estimates that a $25 million ESA program would serve over 13,000 students resulting in a savings of about $4,000 each year for every student receiving an ESA instead of attending a district school.

Those savings add up quickly.

As a result, the Committee on Legislative Research Oversight Division estimates the total savings (after accounting for the cost of tax-credits and

How districts save money

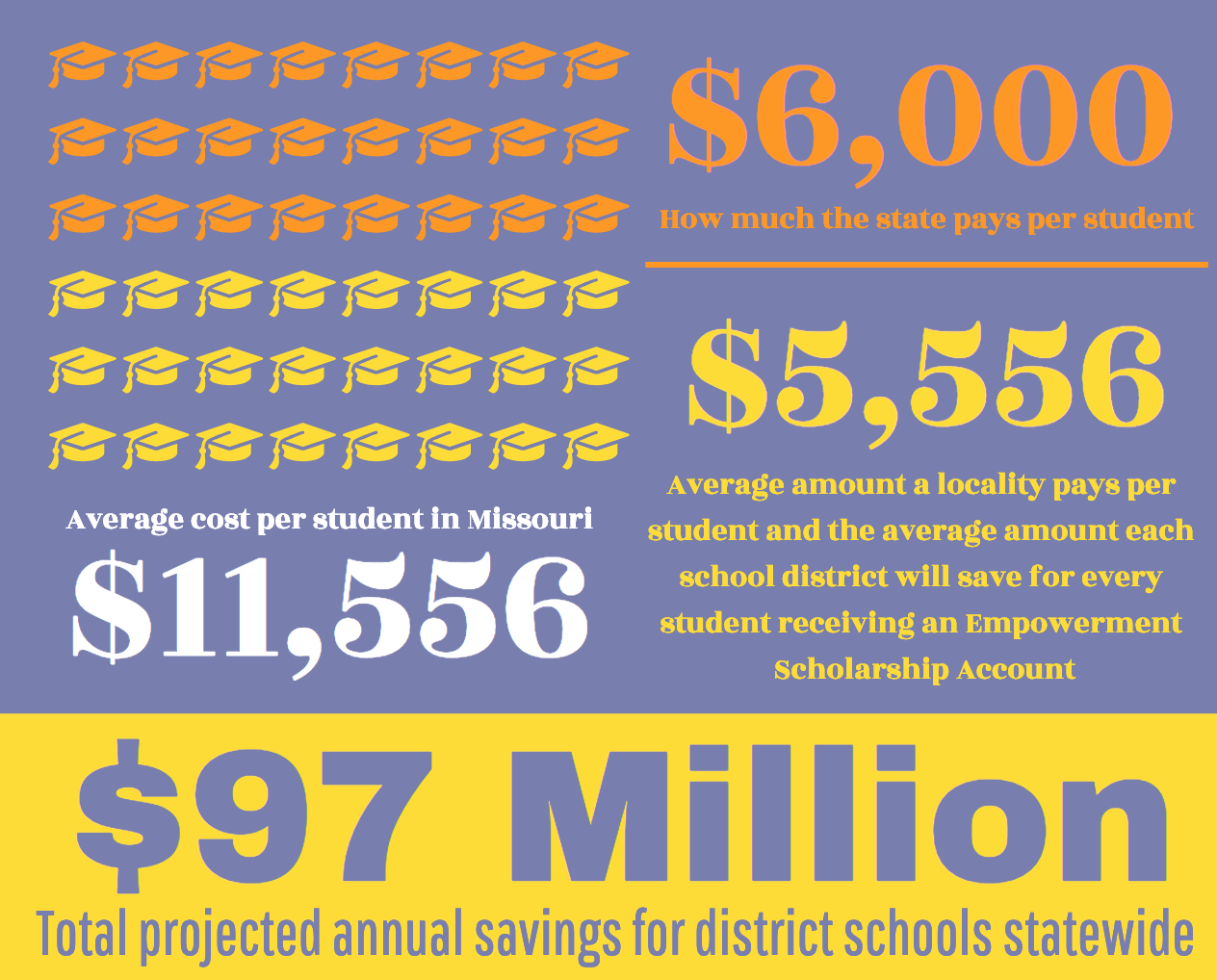

State funding is only a portion of what we spend on educating children in Missouri.

On average, we spend about $11,556 per year educating a child in Missouri, with only $6,000 coming from the state. The other $5,556 comes from local property taxes.

Under an ESA program, students receiving a scholarship will use those funds to attend a different school, meaning the local school district will not have to spend local funding to educate that child even though they are still receiving the local tax revenue.

That means

Even after accounting for fixed costs that may not change as a small number of students leave a school system — things like fixed facilities costs and debt service — the Committee on Legislative Research Oversight Division estimates that savings to local districts statewide could be as large as $97 million per year.

Other states are already realizing these savings

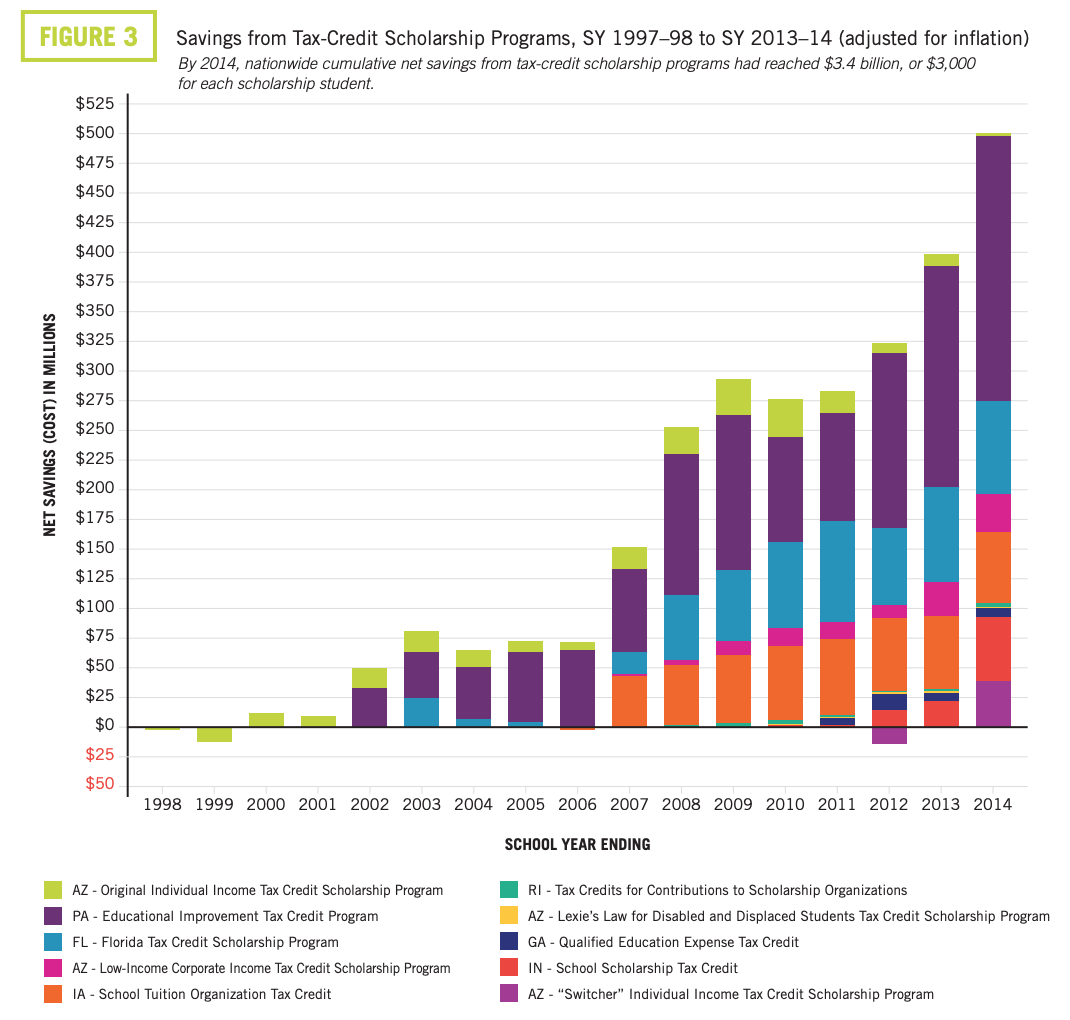

Other states like Florida, Iowa, Indiana, Georgia, Pennsylvania, Arizona, and Rodes Island have successful tax-credit scholarship programs which have seen academic improvement and state savings.

A 2016 study of 10 tax-credit scholarship programs like the one proposed in Missouri showed that states save up to an average of $3,001 per student.

Two of these programs are used as a basis for the Committee on Legislative Research Oversight Division’s analysis of the proposed Empowerment Scholarship Account program in Missouri.

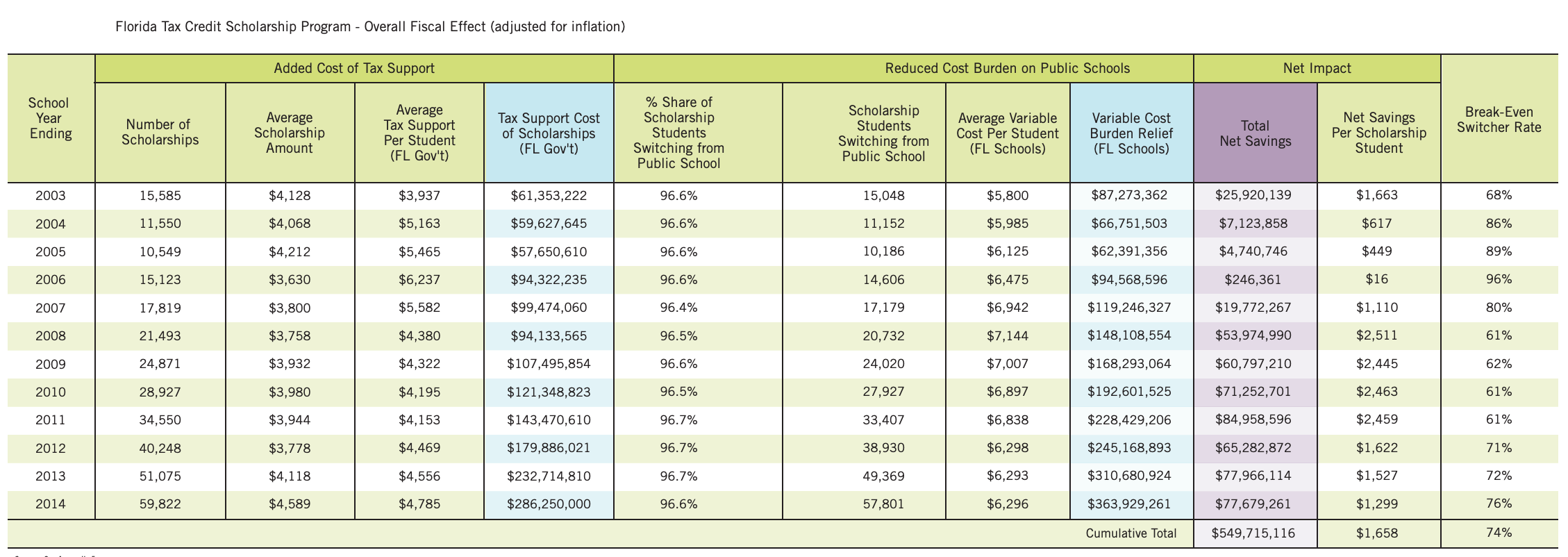

The Florida Tax Credit Scholarship Program has been in operation since 2003 and provides a dollar-for-dollar tax credit for corporations donating to scholarship funds.

In 2014 it served almost 60,000 students with an average scholarship amount of $4,589.

Since its inception, it has saved taxpayers between $371 million and $550 million.

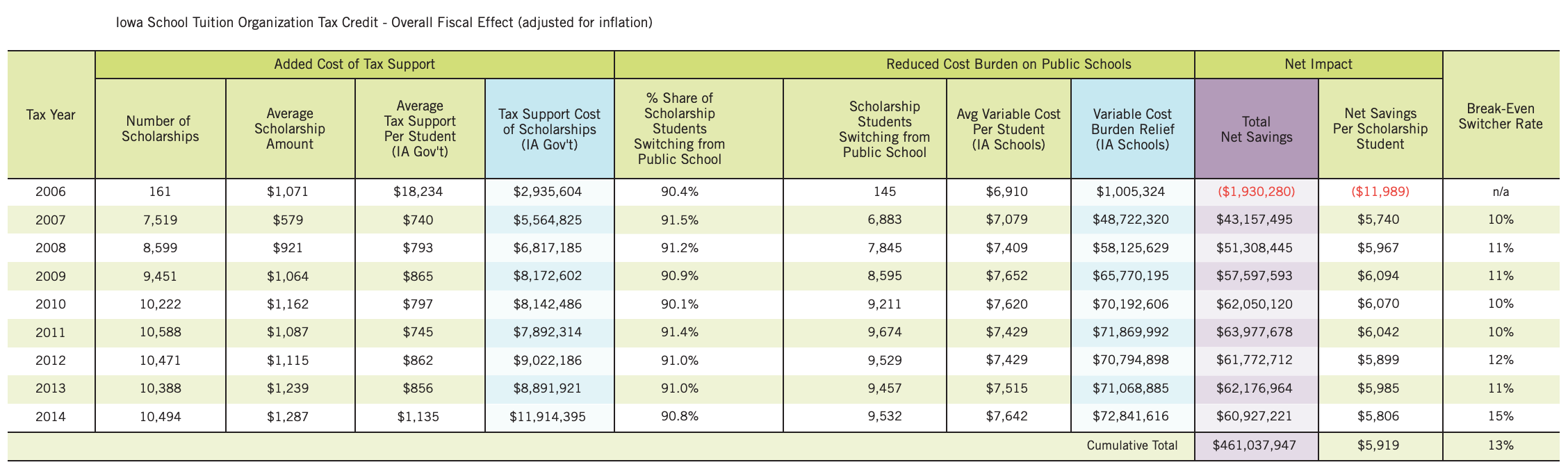

The School Tuition Organization Tax Credit in Iowa has been operating since 2007 and offers 65% tax credits for individual donor and 25% tax credits for corporate donors.

In 2014 it served about 10,500 students with an average scholarship amount of $1,287.

Since its inception, the program has saved Iowa taxpayers between $280 million and $461 million.

« Previous Post: Private school leaders advocate for ESAs

» Next Post: Just the Facts: ESAs are not vouchers